🎯Token Scenario

Liquidity Incentives

Liquidity incentives will be provided in the form of token lock-ups. The monthly reward amount for liquidity incentives will be determined in advance through voting. The earnings from locking $SEX and $SLP tokens will come from the "liquidity incentives" portion of $SEX tokens. Users who hold $SEX and $SLP can lock them up to earn $SEX token rewards and gain voting governance rights. Additionally, $SEX token lock-up users will also receive additional benefits such as discounted trading fees.

Lock & Earn

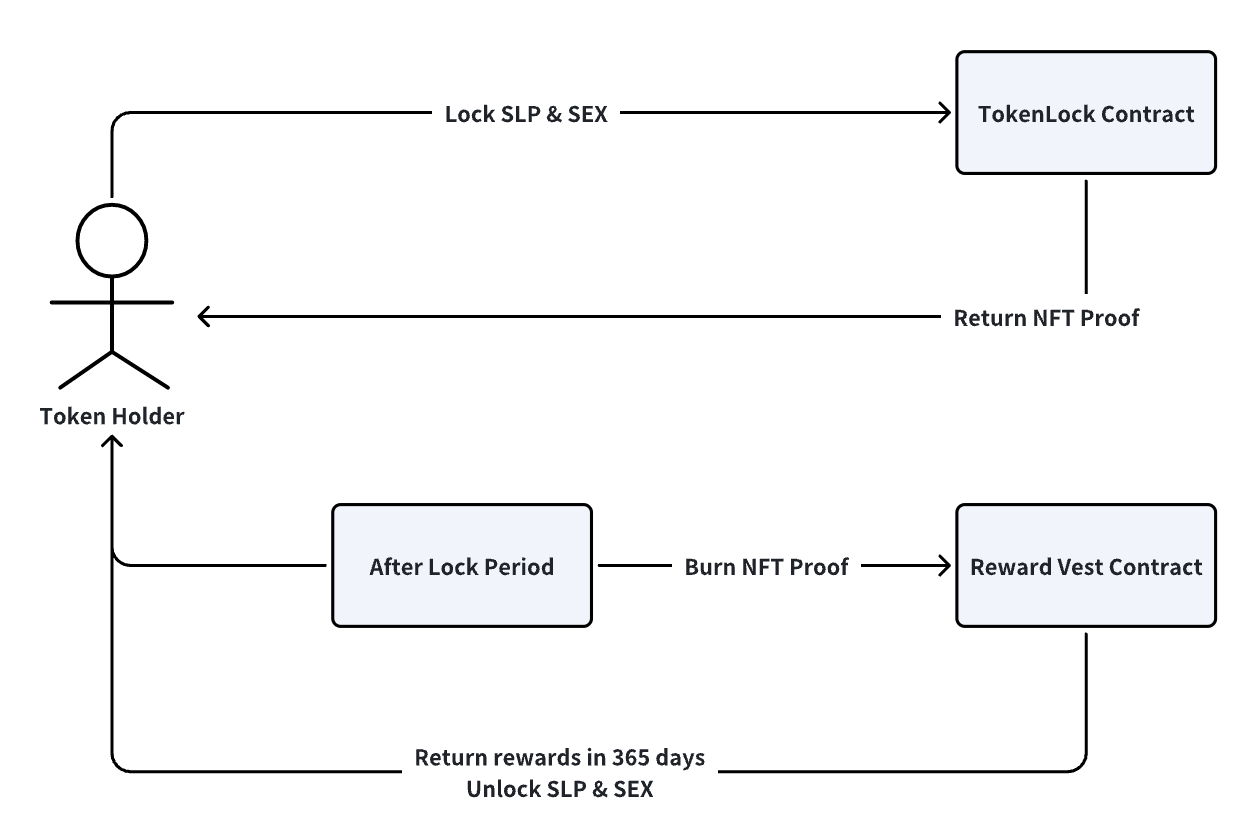

Token holders can lock their $SEX and $SLP tokens for a period of 30 to 720 days. The longer the lock-up period, the higher the potential earnings for the users. During the lock-up period, the locked tokens cannot be withdrawn or transferred. After participating in the lock-up, users will receive a lock-up certificate in the form of an NFT (Non-Fungible Token). Once the lock-up period is reached, token holders can redeem the corresponding amount of locked tokens by destroying the NFT certificate. The earnings generated from the lock-up will be released to the token holders in a linear manner over a period of 365 days after the unlocking.

Case

User A provides 100 USD worth of liquidity and receives 100 SLP tokens. User A decides to lock the 100 SLP tokens for a period of 90 days and receives 1 NFT certificate as proof of the lock-up.

During the lock-up period, User A is unable to withdraw the 100 SLP tokens or the corresponding liquidity assets.

Once the lock-up period expires, User A can destroy the lock-up NFT certificate and retrieve the 100 SLP tokens. The earnings generated from the lock-up, in the form of $SEX tokens, will be released to User A in a linear manner over a period of 365 days, starting from the unlocking date.

It's important for User A to keep the NFT certificate safe, as losing it would result in the inability to retrieve the locked tokens and the corresponding $SEX earnings.

Repurchase & Burn

To promote the circulation of $SEX and maintain its core value, the majority of project earnings will be used for token buybacks and subsequent token burns.

Mechanism

Transaction fee income, SEX/ETH liquidity income, and $SLP burning fees will be sent to the Vault collectively. Among them, 30% of the transaction fee income will be used to cover operational costs such as oracle fees and order execution gas fees, while the remaining 70% of transaction fee income and other earnings will be used to repurchase $SEX in the market. All repurchased $SEX will be burned, and the timing of repurchases and execution of burning will occur randomly.