🪙SEX & SLP

SEX & SLP Design

Substance Exchange carries two tokens:

SEX is Substance Exchange's project token that can be used for voting and locked for a certain amount of time to gain voting rights and fee reductions.

SLP is the token that liquidity providers receive for providing liquidity, has a built-in dollar value, and is transferable. Buying SLP = providing liquidity, selling SLP = withdrawing liquidity.

For users, the primary means of acquiring SEX is by locking SLPs.

Therefore, we encourage users to become long-term LPs on the platform and acquire SLPs along with SEX gains.

In addition, due to the existence of customer service mechanisms such as VIP, obtaining SEX has potential expectations for users, such as lower fees and withdrawal fees.

Price Mechanism

The price of an SLP is determined by the LP's total equity and the number of SLPs outstanding.

In order to more accurately reflect LP's gains and losses, we measure LP equity not only by counting the number of USDX in the pool but also by crediting unrealized gains and losses on user perpetual trading.

SLP Price=(LP Pool Asset Value−User Unrealized Profit)/Number of SLPs

Case Study:

LP Pool Asset Value

1,000 USD

Number of SLP

1,000

Unrealized Profit

500 USD

Borrowing Fees + Funding Fees

100 USD

SLP Price

(1000-400)/1000=0.6

Token Detail

Token Acquisition

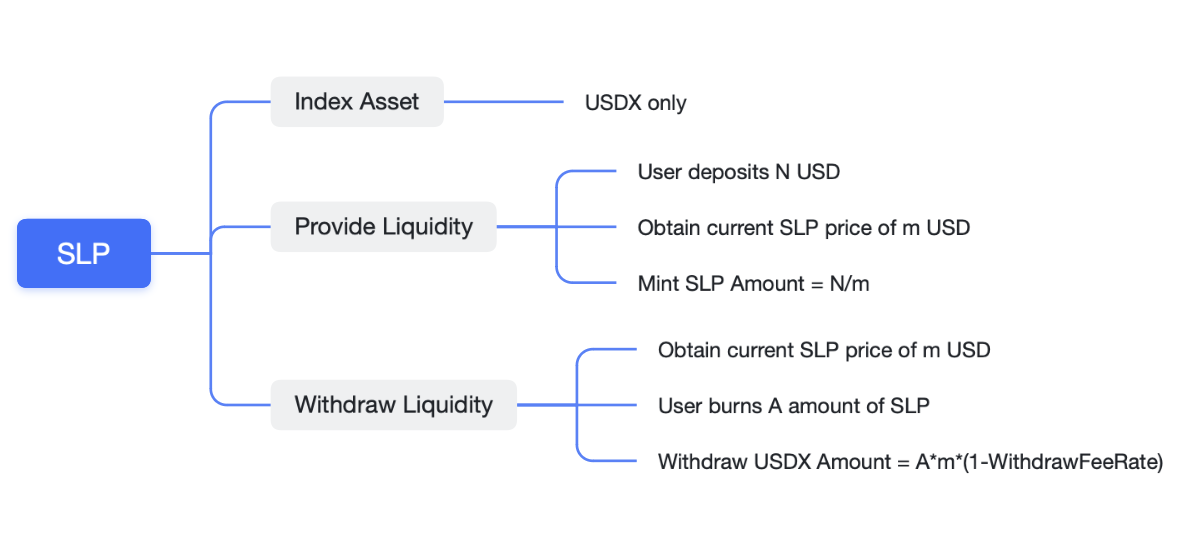

SLP

You can choose whether to invest in the liquidity pool to mint SLP before the end of each cycle. SLP Token needs to follow the value of the assets deposited by the user to be bought and sold. For the liquidity pool, when the users provide liquidity, they shall mint the LP Token of the corresponding value; when the user withdraws liquidity, the LP Token is burned, and the corresponding assets are taken out according to the value of the burned LP Token. It should be noted that when the user interacts with the SLP, the assets do not interact directly with the liquidity pool, but need to wait for the end of the current Epoch to complete the Buy/Sell. Currently, we only support the use of Substance's USDX as an asset in the liquidity pool.

Under normal circumstances, users' requests to withdraw liquidity by selling SLP will be executed smoothly. However, when the liquidity pool is temporarily insufficient, requests for liquidity withdrawal may be partially executed.

The user's destroyable SLP amount:

User’s SLP sell percentage=Total applied sell quantity in the Curren EpochUser’s applied sell quantity

The user can receive USDX amount: User’s obtainable USDX quantity=Current Epoch’s actual sell quantity∗User’s SLP sell percentage∗SLP price

The user's returned SLP quantity: User’s returned SLP quantity=User’s applied sell quantity−(Current Epoch’s actual sell quantity∗User’s SLP sell percentage)

Case Study:

The amount of SLP User A applies to sell

150

The total SLP applied for in the current Epoch

1000

The actual SLP sold in the current Epoch

600

Assuming SLP price

1.00

The amount of USDX User A can receive

90

The amount of SLP returned to User A

60

SEX

In addition to the event rewards, you can get SEX tokens in two ways

By locking SEX & SLP tokens. The longer you lock your position, the more SEX tokens you can get. Locking will be rewarded with SEX Tokens at the end of the lock-up period.

After the launch of the mainnet, the SubstanceX team will add SEX Token liquidity to decentralized exchanges, so that users can buy SEX Token on decentralized exchanges.

In the future, users will have more options to acquire SEX Tokens, such as purchasing from centralized exchanges or earning SEX rewards from various sources. Reward Token from locking will be provided from the "Liquidity Incentive" section.

Lock & Earn

At regular intervals, SubstanceX will send locking rewards to the locking contract, and the proceeds from the reward contract will be transferred to the governance pathway in the future, where SEX holders will determine how many rewards will be distributed from the locking contract in the next cycle.

Once a user starts locking, the contract will mint an NFT for the user, which contains the user's locking quantity, locking time, and locking tokens, and will continue to generate SEX locking rewards. Before the expiration of the locking time, users can not unlock their locked tokens, and can not receive SEX earnings.

When the locking time expires, the user can click "Unlock" to retrieve the locked principal, and at the same time, the SEX token rewards generated from locking will enter a 365-day release period and will be released linearly within 365 days after unlocking, and at this time, the user can click Claim to obtain the SEX token rewards that have been released.

When all the SEX Token rewards in the NFT have been claimed by the user, this NFT will be destroyed.

Both Locked SLP and SEX can generate SEX Token rewards. The only difference between the two is the number of rewards.